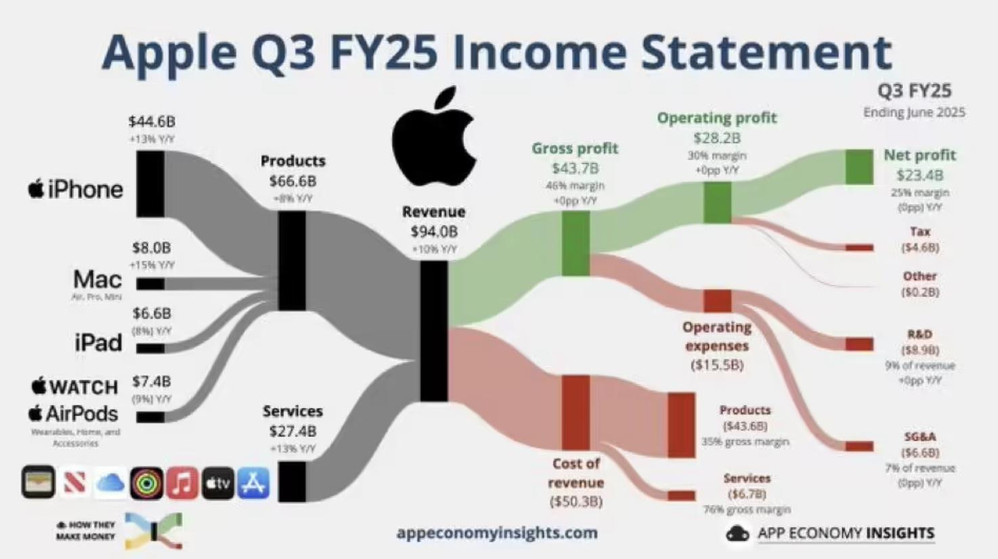

AsianFin -- Apple Inc. reported strong fiscal Q2 earnings late Wednesday, but the numbers failed to dispel a growing sense of unease on Wall Street. While revenue and profit both exceeded expectations—net sales rose 10% to $94.04 billion and net income grew 9% to $23.43 billion—the tech giant’s underwhelming performance in AI and looming tariff pressures continue to weigh heavily on its outlook.

The company’s share price has dropped roughly 16% year-to-date, lagging far behind peers Nvidia Corp. and Microsoft Corp., both of which recently crossed the $4 trillion market cap threshold. Apple, by contrast, remains stuck at around $3.1 trillion. The sluggish trajectory underscores investor concerns that Apple is increasingly playing defense in a rapidly evolving tech landscape.

Shares rose 2.28% in after-hours trading following the earnings release. The board declared a $0.26 dividend per common share, payable on August 14 to shareholders of record as of August 11.

There was one bright spot: Greater China. Revenue in the region climbed 4% year-over-year to $15.37 billion, breaking a string of declines. CEO Tim Cook credited government subsidies and aggressive price cuts for the turnaround. “This was the first quarter fully impacted by Chinese government subsidies,” Cook noted on the earnings call.

The rebound in China helped Apple post growth across all five of its key geographic segments. Revenue in the Americas rose to $41.20 billion from $37.68 billion a year earlier, while Europe posted $24.01 billion, Japan $5.78 billion, and the rest of Asia-Pacific $7.67 billion.

Discounts played a critical role. On JD.com during China’s mid-year 618 shopping festival, Apple’s iPhone 16 series dominated the bestseller charts. Counterpoint Research reported that Apple rose to third place in China smartphone sales in Q2, up from fifth in the previous quarter. “Apple timed its iPhone price cuts well, just ahead of the 618 event,” said Ethan Qi, associate director at the firm.

Still, analysts caution that Chinese demand remains sensitive to price. “It’s not that consumers don’t want iPhones,” said Omdia analyst Zhong Xiaolei, “it’s that the full-price iPhone is simply too expensive.”

Apple marked a major milestone this quarter, with cumulative iPhone shipments surpassing 3 billion units since the product’s 2007 debut. The iPhone remains the company’s cash cow, bringing in $44.58 billion in Q2 revenue—well above expectations. Cook said the iPhone 16 is outperforming the 15, with double-digit sales growth.

Mac revenue came in at $8.05 billion, iPad at $6.58 billion, and wearables and accessories totaled $7.40 billion. Services revenue, now a key profit engine, hit $27.42 billion.

Emerging markets also continue to show promise. Cook highlighted double-digit iPhone sales growth in India and Southeast Asia, with Apple planning its third retail store in Bangalore. IDC’s Huang Zixing noted that iPhones remain aspirational purchases in many of these regions, serving as status symbols as much as communication tools.

But beyond the headline figures, Apple’s strategic vulnerabilities are increasingly coming into focus. The company is falling behind in the AI race—a sector that has fueled Microsoft and Nvidia’s meteoric rises. Despite a wave of market enthusiasm after last year’s WWDC, Apple has failed to deliver meaningful progress on AI deployment, leaving its valuation stuck.

To make matters worse, the company is bleeding talent. Bloomberg’s Mark Gurman recently reported that four AI researchers had defected to Meta in just a month. On the earnings call, Cook said Apple will “significantly increase” its investment in AI and is open to acquisitions. He promised more personalized Siri features next year but offered few specifics.

Estimates suggest a well-executed AI strategy could add up to $75 per share to Apple’s valuation. But patience is wearing thin. “If Apple’s leadership doesn’t adapt fast, they risk making one of the most consequential strategic errors in tech history,” said one analyst.

Compounding Apple’s challenges are rising geopolitical and regulatory headwinds. The company incurred $800 million in tariff-related costs this quarter, and the U.S. is preparing to slap a 25% levy on imports from India—Apple’s newest manufacturing hub—starting August 1. The shift from China to India was meant to diversify supply chains, but the strategy may backfire.

Apple plans to manufacture all iPhones for the U.S. market in India by fiscal 2026. But the new tariffs threaten that pivot, potentially squeezing margins further. Some analysts expect the bill of materials for the iPhone 17 to rise by $20–25, with retail prices for higher-end models likely to jump $50.

Faced with rising costs, Apple is expected to pass some of the burden onto consumers—raising fresh concerns about demand elasticity. Meanwhile, its Detroit-based manufacturing academy and broader $500 billion U.S. investment pledge are unlikely to offset near-term pressures.

Apple’s services business—widely seen as its long-term growth engine—faces threats of its own. Regulatory scrutiny of the App Store’s commission model could shave off up to 10% of Apple’s net profit, according to Bank of America. At the same time, the DOJ is pushing to terminate the company’s lucrative search deal with Google, which generated an estimated 6% of Apple’s total revenue and nearly 20% of its operating profit over the past year.

Looking ahead, Apple is betting on a major refresh. The iPhone 17 series, slated for release next month, will feature a redesigned product line. Hopes are also high for Apple’s first foldable phone, expected in 2026. JPMorgan forecasts sales of 45 million foldables by 2029, potentially bringing in $65 billion in revenue.

Yet despite its $100 billion cash pile, Apple appears constrained—not by resources, but by hesitation. The company that once defined bold product launches now finds itself in a holding pattern, fending off competitors in AI and grappling with policy shifts beyond its control.

Whether Tim Cook’s cautious approach pays off or burdens his successor with a heavier lift remains an open question. One thing is clear: Apple can no longer afford to watch the AI era unfold from the sidelines.